cassie75516000

About cassie75516000

The Way to Get a Personal Loan With Bad Credit Today

Securing a personal loan can be a difficult endeavor, particularly in case you have bad credit. Nevertheless, it isn’t impossible. With the proper methods and understanding of the lending landscape, you can find options that suit your financial wants. This article will provide you with essential insights and sensible steps that will help you obtain a personal loan even with a less-than-excellent credit score rating.

Understanding Bad Credit

Earlier than diving into the loan utility process, it’s necessary to understand what unhealthy credit means. Credit scores usually vary from 300 to 850, with scores under 580 thought of poor. A low credit score score can end result from various elements, together with missed funds, high credit score utilization, or bankruptcy. Lenders use credit score scores to evaluate the chance of lending money. Due to this fact, having bad credit score typically leads to increased interest rates or denial of loan applications.

Assess Your Credit Situation

The first step in obtaining a personal loan with dangerous credit is to evaluate your financial situation. Get hold of a replica of your credit score report from major credit score bureaus (Equifax, Experian, and TransUnion). Overview the report for any inaccuracies or outdated info that may very well be negatively impacting your rating. If you find errors, dispute them with the credit score bureau to potentially improve your score.

Enhance Your Credit score Rating

Whereas it might not be feasible to drastically enhance your credit rating in a single day, taking some steps will help. Listed here are just a few methods:

- Pay Your Bills on Time: Constantly making on-time payments can step by step enhance your credit score score. Arrange reminders or automated funds to avoid lacking due dates.

- Scale back Bank card Balances: Goal to lower your credit score utilization ratio (the amount of credit you’re using in comparison with your whole out there credit). Retaining this ratio beneath 30% can positively influence your credit score score.

- Keep away from New Exhausting Inquiries: Every time you apply for credit score, a tough inquiry is made in your report, which may decrease your score barely. Limit new functions before making use of for a loan.

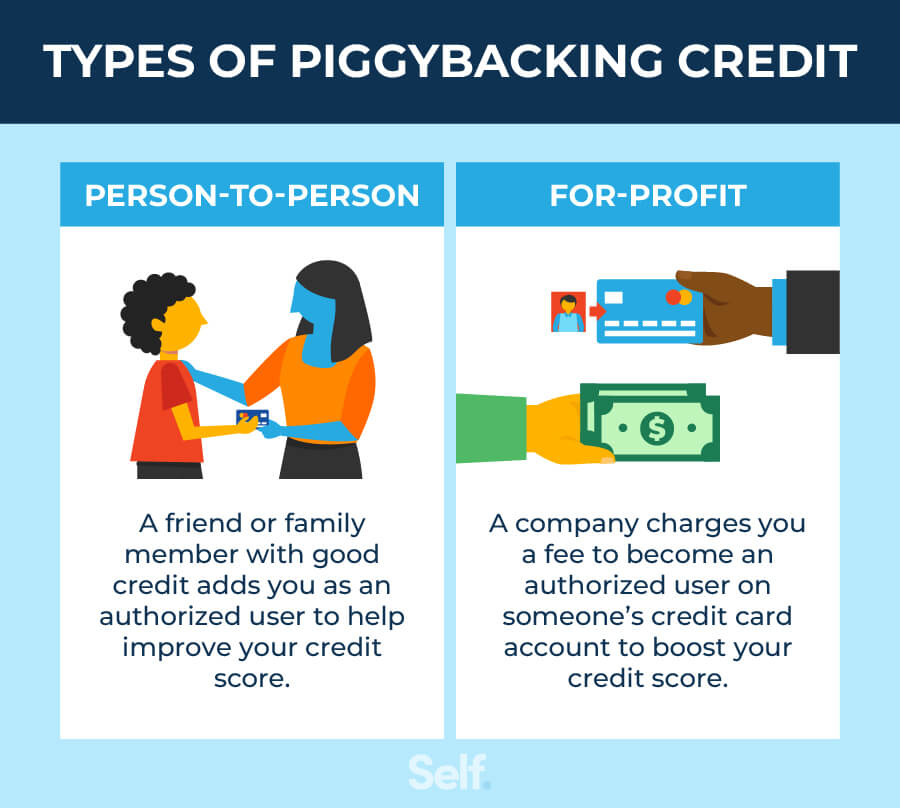

- Consider Turning into an Authorized Consumer: In case you have a family member or buddy with good credit score, ask if they’ll add you as an authorized consumer on their bank card. Their constructive fee historical past might help enhance your credit rating.

Explore Loan Choices

- Credit Unions: Credit unions typically have extra flexible lending standards than conventional banks. If you’re a member of a credit score union, inquire about their personal loan choices for people with unhealthy credit.

- Online Lenders: Many on-line lenders specialise in loans for people with unhealthy credit. These lenders could supply extra lenient terms and sooner approval processes. However, be cautious and analysis their reputations earlier than proceeding.

- Peer-to-Peer Lending: Platforms like Prosper or LendingClub connect borrowers with individual investors. These platforms could provide loans with more favorable terms than conventional lenders.

- Secured Loans: Should you own worthwhile property (like a automotive or savings), consider making use of for a secured loan. Any such loan makes use of your asset as collateral, which can make it simpler to obtain approval even with unhealthy credit score.

Compare Loan Provides

After getting identified potential lenders, examine their loan gives. Look for the following factors:

- Interest Charges: Greater curiosity charges can considerably enhance the total value of the loan. Intention for the lowest charge attainable.

- Loan Phrases: Consider the size of the loan. An extended time period could end in smaller month-to-month payments, but you would end up paying more in curiosity over time.

- Charges: Bear in mind of any origination charges, prepayment penalties, or other prices that could affect the general price of the loan.

- Monthly Payments: Be sure that the monthly funds match inside your finances. It’s essential to decide on a loan which you can comfortably repay.

Put together Your Documentation

When applying for a personal loan, lenders would require documentation to assess your monetary situation. Common paperwork include:

- Proof of Revenue: Pay stubs, tax returns, or financial institution statements to verify your earnings.

- Identification: A government-issued ID, akin to a driver’s license or passport.

- Social Safety Number: To test your credit historical past.

- Proof of Tackle: Utility bills or lease agreements to verify your residence.

Having these documents prepared can expedite the application course of.

Apply for the Loan

After you have chosen a lender and prepared your documentation, it’s time to apply. Many lenders supply on-line functions, which are handy and infrequently result in faster choices. Be honest about your credit situation and provide accurate information to avoid delays or complications.

Consider a Co-Signer

If you’re struggling to secure a loan by yourself, consider asking a trusted pal or household member with good credit to co-sign your loan. Should you loved this post and also you desire to obtain more info relating to Get a personal loan with bad credit today (https://personalloans-badcredit.com/) kindly check out our own web site. A co-signer agrees to take duty for the loan if you default, which may enhance your possibilities of approval and doubtlessly lower your interest fee.

Be Cautious of Predatory Lending

While looking for a personal loan, be cautious of predatory lenders who could reap the benefits of your unhealthy credit scenario. These lenders usually charge exorbitant interest rates and charges, making it tough to repay the loan. Always read the high quality print and make sure you understand the terms earlier than signing any agreement.

Create a Repayment Plan

When you secure a personal loan, create a repayment plan to manage your payments successfully. Set reminders for due dates and consider setting up computerized payments to keep away from late charges. Should you encounter financial difficulties, communicate together with your lender as they could provide choices that will help you handle your payments.

Conclusion

Acquiring a personal loan with bad credit score might be challenging, however it’s achievable with the right strategy. By understanding your credit scenario, exploring varied loan options, and making ready your documentation, you possibly can enhance your possibilities of approval. At all times examine gives, be cautious of predatory lenders, and create a strong repayment plan to make sure your financial stability. Remember, bettering your credit score score over time will open up extra opportunities for better loan phrases sooner or later.

No listing found.